When thinking of the products that revolutionize our world, it’s easy to think of it as a single moment of great inspiration, or a lightbulb moment (think Albert Einstein and eureka).

However, the truth of the matter is that the most successful products are typically the result of many years of study, experimentation, hard work, failure, and repetition – aka research and development (R&D). Whether you are part of a sophisticated Fortune 500 company or a small startup, R&D is the first step to lasting success.

In this article, we’ll explore the cost of R&D and the basics of R&D tax credits, including the benefits for businesses and the impact on the wider economy. Let’s dive in!

What is Research and Development (R&D)?

Research and development is defined as the activities that companies, corporations, or governments undertake to innovate and introduce new products and services. R&D also encompasses improvements to existing products and services. It can include both the work done by engineers to develop new products, as well as research done by industrial scientists that may result in future unspecified products.

Many people think of pharmaceutical or technology companies when they hear R&D, but most other industries invest time and resources into R&D as well. For example, a cereal brand’s many variations and flavorings on its original product are the results of R&D.

Basic vs. Applied Research: What’s the Difference?

There are two main types of R&D: basic and applied.

Basic research (aka fundamental research) focuses on improving our understanding of a particular problem or phenomenon through the exploration of big questions. Some examples of basic research questions are:

- Why are people allergic to gluten?

- What is the specific genetic code of the fruit fly?

This type of research can help companies acquire new knowledge, but its focus on research for its own sake means the financial benefits are uncertain. Consequently, this type of research is primarily performed by large corporations, universities, and government agencies.

Applied research, while also done to acquire knowledge, is done with a specific goal, use, or product in mind. It’s more practical with a focus on finding workable solutions for current problems. Examples of applied research questions include:

- What combination of flours will produce the best gluten free bread?

- What compound can we use to treat X disease?

Applied research helps businesses determine market needs and trends, then mold their products accordingly. It also helps organizations find real-world solutions to specific problems. Unlike basic research, which focuses on making theories that explain things, applied research focuses on describing evidence to find solutions.

The Cost of Research and Development (R&D)

There’s no question about it — R&D is a risky, but necessary venture. It requires significant investment in salaries, materials, and equipment, and it’s not uncommon for companies to never see a return on investment (ROI). In 2022, R&D costs amounted to nearly $2.5 trillion worldwide.

But the enormous costs rarely act as a deterrent. Instead, R&D investments have tripled over the past 20 years (taking inflation and cross-economy price differences into account), from $672 billion in 1992 to $2.5 trillion in 2022. Interestingly, investments are increasing from jurisdictions outside of the 38 Organization for Economic Co-operation and Development (OECD) countries. In 1992, OECD members accounted for virtually all global R&D, since then OECD R&D has grown, as has its intensity. Now 30% of all R&D comes from outside the OECD, economies like Taiwan and Russia account for some, but over 80% comes from China.

The United States and China are by far the two largest R&D spenders. In 2022, the US spent $680 billion while China spent $550 billion. However, when the expenditure is compared as a share of overall gross domestic product (GDP), smaller countries with tech-heavy economies such as Israel and South Korea invest larger shares of their GDPs into R&D, indicating a stronger relative focus on science and innovation.

In today’s fast-paced business world, R&D and innovation is key to staying ahead of the competition. R&D tax credits provide a much-needed boost to companies that invest in innovation. These government incentive programs reward businesses for their R&D efforts, helping to offset some of the associated costs. By utilizing R&D tax credits, companies can secure significant funding to drive growth, improve products and services, and stay ahead of the competition.

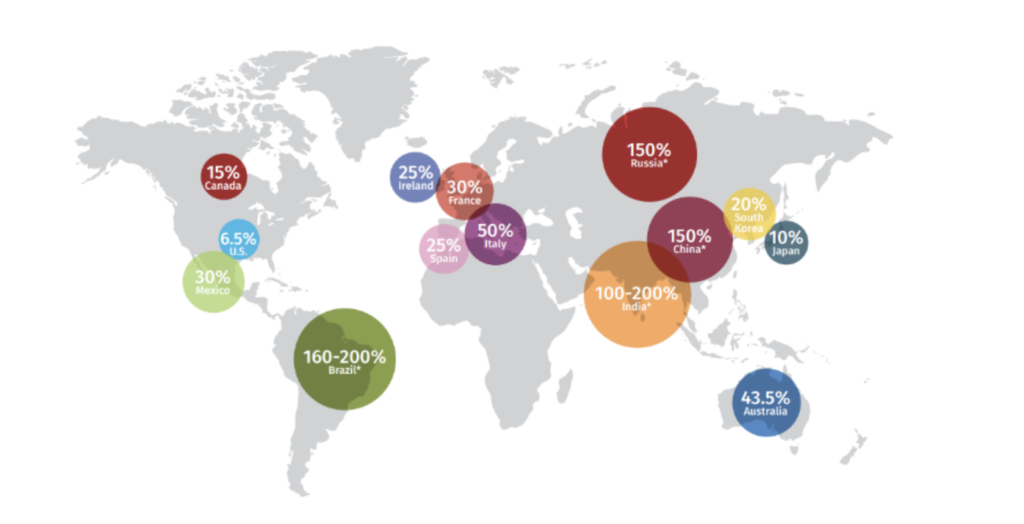

Currently, more than 50 jurisdictions have some form of an R&D tax incentive.

R&D Tax Credits

R&D tax credits aren’t just for rocket scientists and researchers working to cure cancer. They can also be used for applied science, product/service improvement (such as making existing products quicker, cheaper, or better), and to launch new innovations or improve manufacturing processes.

Because innovation is directly correlated with economic growth, more countries are adding incentives and increasing R&D support through grants and other forms of funding. Currently, more than 50 jurisdictions have some form of an R&D tax incentive.

R&D tax credits offer economic benefits to individual companies and the wider economy. For example, by reducing the cost of R&D expenditures, companies can spend more time and money on R&D. This results in new products and technologies hitting the market in less time, with less risk. It also creates new jobs, which leads to economic growth. Plus, R&D tax credits support the growth of new industries and businesses, particularly in the areas of science and technology.

However, 80% of potentially qualifying small-to-midsized businesses don’t believe they qualify for federal credits or have an easy path to get them. For instance, less than three in 10 businesses that qualify for R&D tax credits claim them, while nearly every large corporation actively makes these claims.

Every year, countless businesses miss out on the R&D tax credit. This is especially true for smaller businesses and startups. These companies wrongly assume they don’t have the revenue needed to qualify. In reality, small and pre-revenue companies can take advantage of the research and development program.

Summary of Available R&D Tax Credits

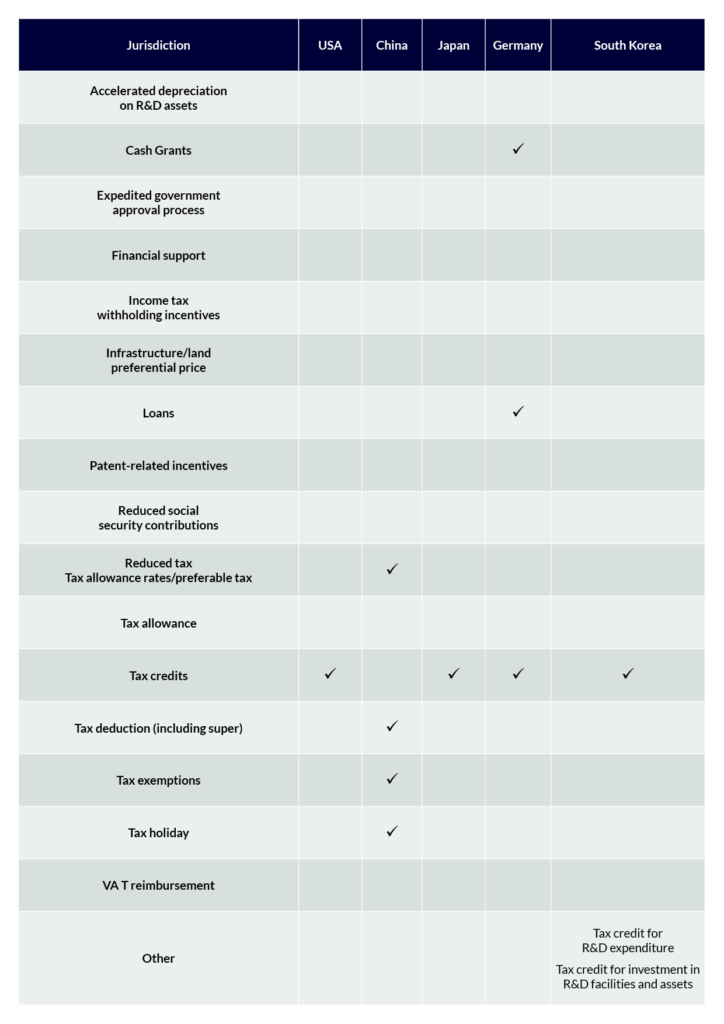

There are various R&D incentives available, depending upon jurisdiction and its specific goal(s). The most common credits include, but are not limited to:

- R&D Tax Credit: These credits directly reduce the tax liability due from the taxpayer after the liability has been computed.

- R&D Deduction/Super-deduction: These tax deductions effectively reduce the tax base before the tax liability is computed, reducing the taxable amount before assessing the tax.

- Accelerated Depreciation on R&D Assets: Accelerated depreciation expense provisions may be allowed on R&D assets such as machinery and equipment.

- R&D Grants: These grants are offered to fund various R&D activities and are typically targeted to industries, company sizes, and activity types.

- Patent-Related Incentives: A patent/intellectual property (IP) box regime tax business income earned from IP at a rate below the statutory corporate income tax rate.

- Payroll-Related Incentives: Payroll-related incentives include income tax withholding incentives and reduced social security contributions.

- Other R&D Incentives, Including Loans: Other R&D incentives can include, but are not limited to, the following: financial support, loans, reduced (preferential) tax rates, tax allowances, tax exemptions, tax holidays, and VAT reimbursements.

To understand this in action, let’s take the example of Pharmaxis, which secured almost A$5 million in R&D tax incentives.

Pharmaxis Ltd. received a tax refund of A$4,953,337 for the 2022 fiscal year from the Australian Government’s R&D tax incentive. This incentive is payable in cash, offered in return for eligible R&D expenditure for companies with total revenue of less than A$20 million in the claimed year. Pharmaxis CEO said, “The R&D tax incentive is a significant source of non-dilutive funding for the company’s clinical development pipeline including PXS-5505 in myelofibrosis and liver cancer, PXS-6302 in established scars and PXS-4728 in isolated REM sleep behavior disorder.”

Closing Thoughts: R&D Tax Credits Can Help You Save, Big Time

Research

and development tax credits offer businesses a way to offset R&D

costs, increase productivity, and speed up time to market. In addition,

these incentives also support the growth of new industries and

technologies which, in turn, drives economic development and job

creation.