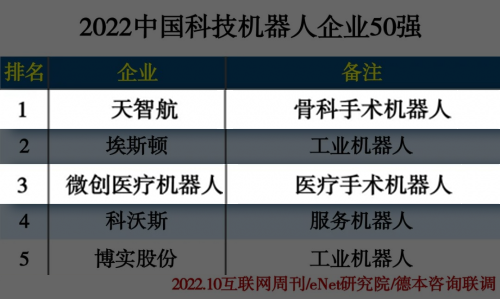

With the rapid development and in-depth application of artificial intelligence, intelligent sensing and other technologies, China’s medical robot industry is entering a stage of leapfrog development. A few days ago, the “Internet Weekly” of the Chinese Academy of Sciences, Deben Consulting, and the eNet Research Institute jointly announced the “2022 Top 50 Chinese Technology Robot Enterprises”, and Beijing Tianzhihang Medical Technology Co., Ltd. (hereinafter referred to as “Tianzhihang”) ranked first, second to The four are Estun, MicroPort Robot, Ecovacs and Boshi, of which Tianzhihang and Shanghai MicroPort Robot (Group) Co., Ltd. (hereinafter referred to as “MicroPort Robot”) belong to the field of surgical robots.

Surgical robot is a kind of precise medical equipment. Surgeons can use the robot to remotely control and perform dexterous and precise surgical operations through tiny incisions. It is a precision operation robot. There are several categories such as natural orifice and percutaneous puncture.

Tianzhihang mainly focuses on the field of orthopedics, and is the first company in China and the fifth in the world to obtain a medical robot registration license. The company’s core product is the Dimensity orthopedic surgical robot, which has now been updated to the third generation; while the products of the minimally invasive robot cover the five “golden tracks” of endoscopic, orthopedic, pan-vascular, natural orifice and percutaneous puncture ”, and its core products include Tumai® endoscopic surgical robot, Honghu® orthopedic surgical robot, etc.

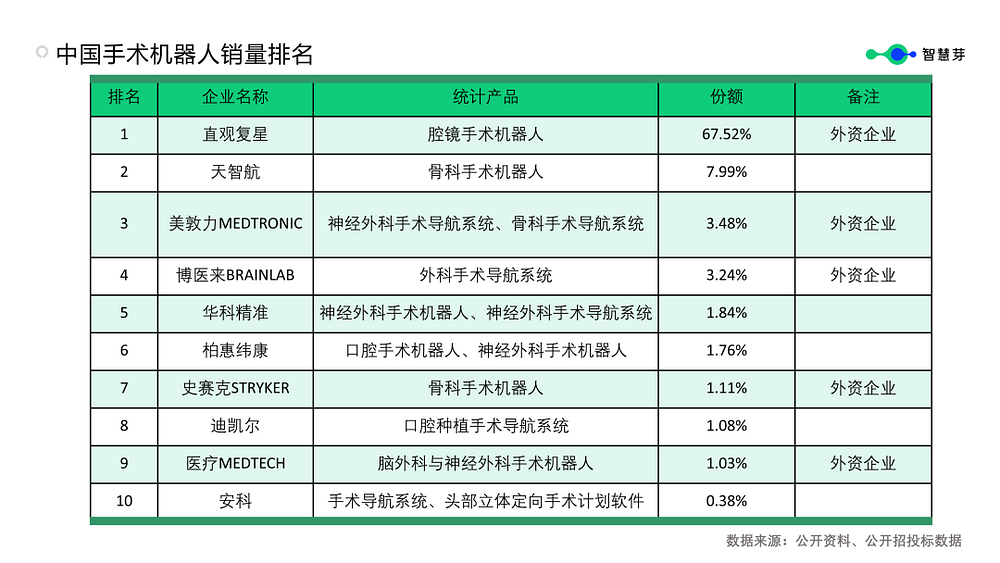

According to public bidding data, Intuitive Fosun occupies 67.52% of the domestic surgical robot market, and Tianzhihang ranks second with 7.99%. According to Tianzhihang’s 2021 annual report, the company achieved operating income of 156 million yuan during the reporting period, a year-on- year increase of 14.80% ; as of the end of 2021, the total number of operations during the reporting period exceeded 10,000, a year-on-year increase of more than 60%. According to the 2021 annual report of MicroPort Robotics, the company achieved operating income of 2.150 million yuan during the reporting period, with a net loss attributable to the parent company of 583 million yuan, and the loss increased by 179.08% year-on-year.

The following is a further analysis of the two companies from the perspective of technology research and development:

Patent layout direction

According to the data of PatSnap, Tianzhihang currently has more than 300 published patent applications and more than 30 registered software copyrights, including about 100 invention patents, accounting for 32.38% of the total patent applications; there are currently 400 MicroPort robots. The remaining patent applications have been published, including about 300 invention patents, accounting for 84.40% of the total patent applications.

In addition, according to the comparison of enterprises on the PatSnap Creativity Evaluation Platform, the number of valid patent applications for MicroPort robots in the past five years is higher than that of Tianzhihang.

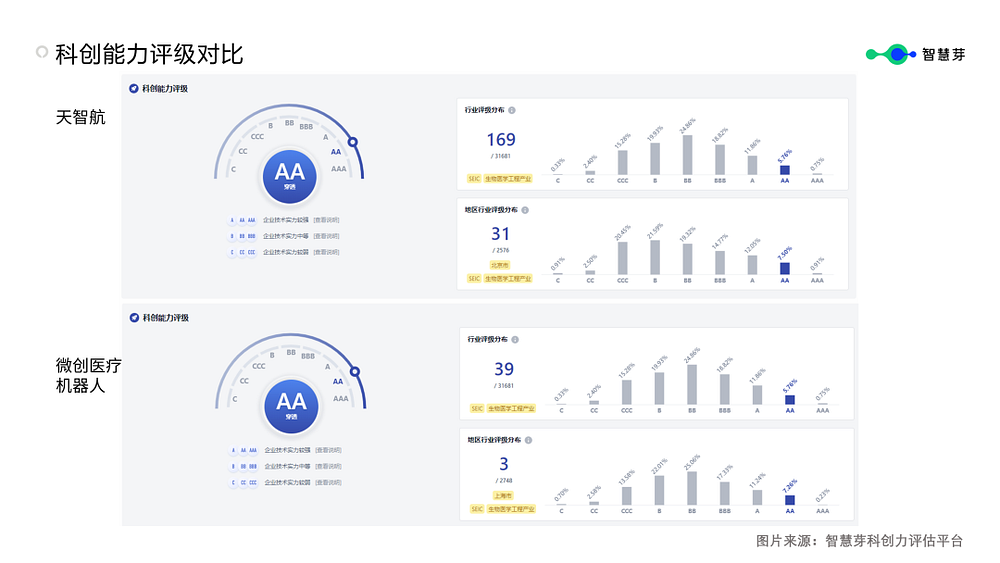

It is worth noting that according to the multi-dimensional evaluation of the company’s competitiveness, R&D scale and stability, technical layout, technical quality, technical influence, etc., the smart buds innovation evaluation platform shows that Tianzhihang and Minimally Invasive Robot are in the biomedical engineering industry. The science and technology ability level is AA level. Further through equity penetration analysis, it was found that Tianzhihang ranked 169th among the more than 30,000 biomedical engineering industry-related technology companies in the country, and MicroPort Robot ranked 39th among the more than 30,000 biomedical engineering industry-related technology companies included in the PatSnap Innovation Evaluation Platform .

From the perspective of technical layout, since Tianzhihang was established in 2010, the annual patent application volume has shown a significant upward trend, and the current patent layout is mainly concentrated in technical fields such as surgical robots, positioning systems, tracers, and markers. Since its establishment in 2015, the annual patent application volume of Minimally Invasive Robot has also shown a significant upward trend. The current patent layout mainly focuses on technical fields such as surgical robots, surgical instruments, robotic arms, and endoscopes.

From the perspective of overseas patent layout, both companies have started to expand their global technology layout. Currently, the number of PCT applications of Tianzhihang is 11, and there is a total of 1 application within the specified validity period. It has been deployed in 8 countries/regions except mainland China, and the country/region with the largest number of patents is the United States. The number of PCT applications for MicroPort® robots is 56, a total of 21 within the specified validity period, and they have been deployed in 12 countries/regions except mainland China, of which the country/region with the largest number of patents is Brazil.

For the surgical robot industry with high technical barriers, industry experts believe that if domestic enterprises want to break through the current market penetration rate, the pace of independent innovation and commercialization of enterprises requires an in-depth combination of production, education, research and medicine. According to the Creativity Evaluation Platform of PatSnap, Tianzhihang has carried out 14 industry-university- research cooperation with other companies, universities, research institutes and other institutions, and has carried out several medical researches in the field of orthopaedic surgical robots with Beihang University and Beijing Jishuitan Hospital. Industry-university-research cooperation. MicroPort Robotics has conducted 6 industry-university- research cooperation with other companies, universities, research institutes and other institutions.

R&D input and output direction

Judging from the R&D investment intensity in the past year, Tianzhihang will spend 110 million yuan on R&D in 2021, and the R&D investment intensity (R&D expenses/revenue) will be 70%. In addition, according to the latest three quarterly reports, the research and development investment in the first three quarters of 2022 has exceeded 80 million, and the investment in research and development infrastructure is still continuing to increase. Among them, the clinical registration of TKA (Total Knee Replacement Robot) products is the clinical trial. The surgery is all done. In 2021, the research and development expenses of MicroPort Robots will be as high as 393 million yuan, and the R&D investment intensity (R&D expenses/revenue) will be 31,440% .

Judging from the R&D output in the past year, the intelligent bud R&D information base shows that in the technical topic of surgical robots, there are more than 20 newly disclosed patented technologies for minimally invasive robots; in addition, Tianzhihang subdivides technical topics in orthopedic joints More than 10 new patents have been laid out.

At present, domestic surgical robots are still in their infancy, and there is still a huge market space. It is expected that more domestic companies will consolidate technology research and development and create dazzling achievements in this track.