Since 2105, driven by my country's policy of vigorously developing new energy vehicles, the new energy vehicle market has shown explosive growth, and it has also accelerated the research and development and application of lithium batteries.

Data show that China's lithium battery industry is developing rapidly, and my country has become the world's largest lithium battery consumer market for five consecutive years. In 2021, the global lithium-ion battery market will reach 545GWh, of which, China's lithium-ion battery market will be about 324GWh, accounting for about 59.4% of the global market.

Lithium battery, also known as lithium-ion battery, is a representative of modern high-performance batteries. It mainly relies on lithium ions to move between the positive and negative electrodes to work. Lithium-ion batteries have the advantages of small size, high energy density, long cycle life, and low environmental pollution, and are widely used in new energy vehicles, energy storage industries, and consumer electronics.

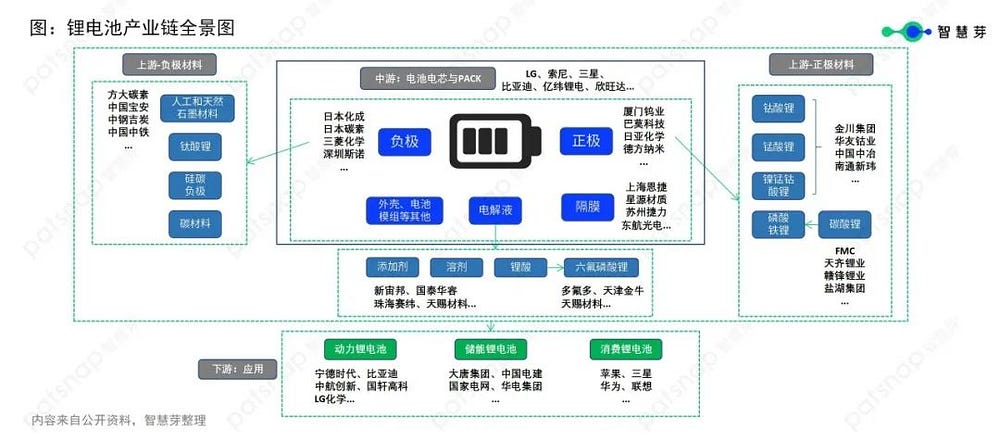

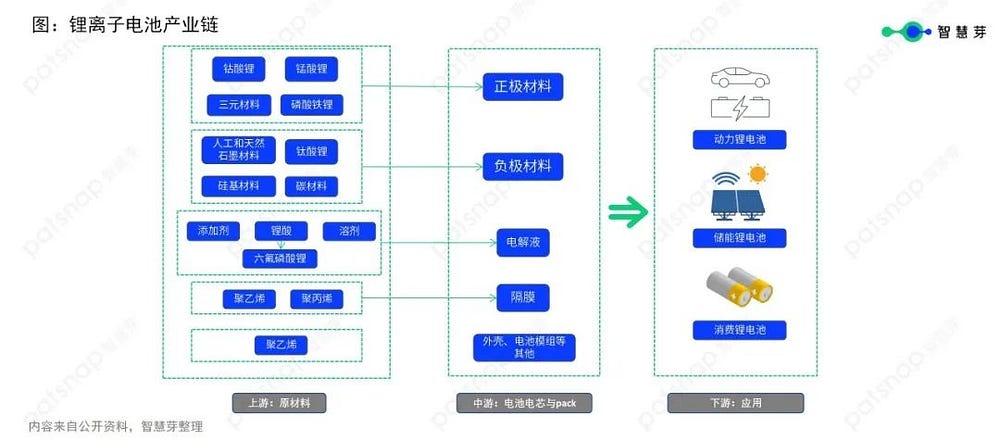

Lithium-ion battery industry chain

The lithium-ion battery industry chain consists of upstream raw materials, midstream battery cells and PACK, and downstream lithium battery applications.

Segment product competition landscape

1. Competitive landscape of the cathode material market

The upstream raw materials of lithium batteries include lithium, cobalt, manganese, nickel, graphite ore, etc., which mainly include:

- Positive electrode materials: lithium cobaltate, lithium manganate, ternary materials, lithium iron phosphate;

- Anode materials: artificial graphite and natural graphite anode materials, lithium titanate, silicon carbon anode, carbon materials;

- Electrolyte: solvents, additives, lithium hexafluorophosphate, new lithium salts;

- Diaphragm: polyethylene, polypropylene;

- Other auxiliary materials: copper foil, aluminum foil, conductive agent, dispersant, aluminum-plastic film, adhesive, etc.

Lithium battery cathode materials account for more than 40% of the total cost of lithium batteries, and are the most critical materials for lithium batteries. The data shows that the scale of China's lithium battery cathode material market has increased from 41.71 billion yuan in 2017 to 75.19 billion yuan in 2020. In the competitive landscape of China's lithium battery cathode material market, Xiamen Tungsten Industry accounted for the largest 9.92%, and Tianjin Bamo accounted for up to 6.44%, German nanometer accounted for 6.31%, Rongbai lithium battery accounted for 5.82%, and Changyun lithium battery accounted for 5.70%.

According to PatSnap data, Xiamen-Tungsten Co.,Ltd. currently has more than 590 published patent applications and 9 registered software copyrights, among which invention patents account for 70.05% of the total patent applications; Tianjin Bamo Technology Co., Ltd. currently There are more than 200 published patent applications, of which invention patents account for 85.83%; Shenzhen-Dynanonic Co., Ltd. currently has more than 110 published patent applications, of which invention patents account for 95.69%; Ningbo Rongbaixin Energy Technology Co., Ltd. currently has more than 210 published patent applications, of which invention patents account for 67.61%; Hunan Changyuan Lithium Technology Co., Ltd. currently has more than 130 published patent applications, of which invention patents account for 77.04%.

According to the enterprise PK function of the PatSnap Creativity Evaluation Platform, among the above-mentioned enterprises, the number of valid patent applications of Xiamen Tungsten Co., Ltd. in the past five years and the concentration of patent layout are higher than the other four enterprises.

Picture source: Enterprise PK of PatSnap Creativity Evaluation Platform

Among the cathode materials of lithium batteries, lithium cobalt oxide is mainly used in the field of consumer electronics products. Lithium iron phosphate and ternary lithium batteries are the two mainstream technical routes of domestic power batteries.

Lithium iron phosphate material is rich in production resources, and its cost, cycle life and safety are superior to ternary materials, but its low-temperature performance is not as good as that of ternary lithium batteries. It is currently widely used in commercial vehicles, low-end passenger vehicles, and energy storage. Ternary lithium batteries (the positive electrode is made of ternary materials) have higher energy density than lithium iron phosphate, higher charge rate, and better low-temperature performance. Currently, they are mainly used in mid-to-high-end passenger cars and other fields.

2. Competitive landscape of the anode material market

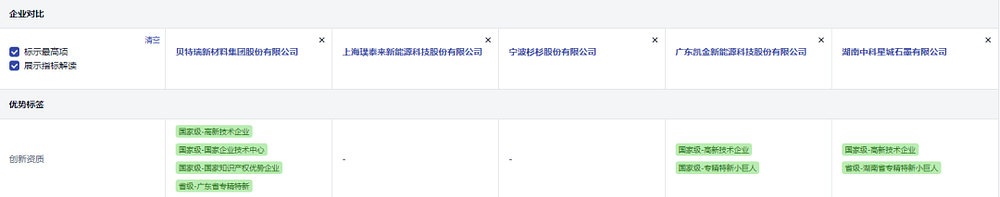

The data shows that the market size of lithium battery anode materials in my country has increased from 6.46 billion yuan in 2016 to 14.02 billion yuan in 2020, with an average annual compound growth rate of 21.4%. In the competitive landscape of China's lithium battery anode material market, in terms of shipments, Bertray accounts for the largest share, reaching 22%. Followed by Putailai accounted for 18%. Shanshan, Kaijin Energy, and Zhongke Star City accounted for 17%, 14%, and 7% respectively.

According to PatSnap data, Btr New Material Group Co., Ltd. currently has more than 450 published patent applications, of which invention patents account for 95.21% of the total patent applications; Shanghai Putailai New Energy Technology Co., Ltd. currently has a total of More than 20 patent applications have been published, of which invention patents account for 80.00%; Ningbo Shanshan Co., Ltd. currently has more than 40 published patent applications, of which invention patents account for 4.55%; Dongguan Kaijin New Energy Technology Co., Ltd. The company currently has more than 270 published patent applications, of which invention patents account for 73.99%; Hunan Zhongke Xingcheng Graphite Co., Ltd. currently has more than 100 published patent applications, of which invention patents account for 94.17%.

According to the enterprise PK function of the PatSnap Creativity Evaluation Platform, among the above-mentioned enterprises, the number of valid patent applications and the concentration of patent layout of Beiterui New Materials Group Co., Ltd. in the past five years are higher than the other four enterprises.

Picture source: Enterprise PK of PatSnap Creativity Evaluation Platform

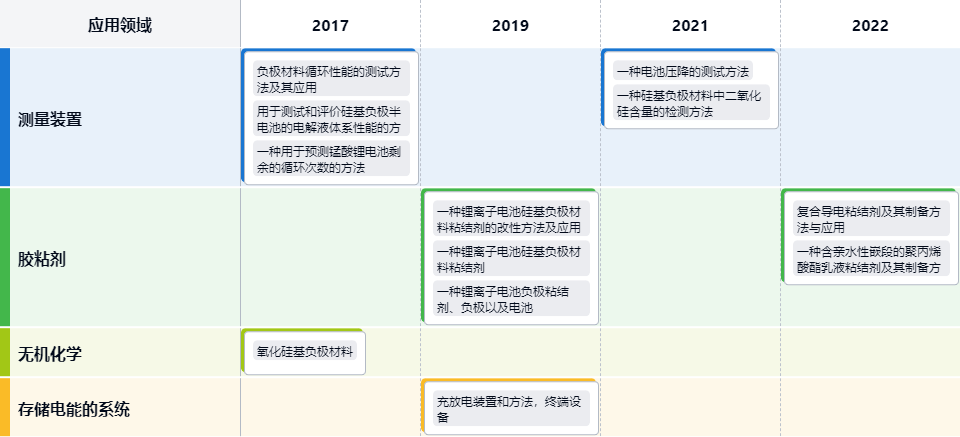

With the development of new energy vehicles, the demand for energy density and fast charging performance of power batteries is getting higher and higher. The anode material of Kirin battery in Ningde era uses silicon-based anode, and Tesla's 4680 battery also uses silicon-based anode Material. According to PatSnap R&D Information Database, silicon-based anode -related R&D has been mainly applied in the fields of measuring devices, adhesives, inorganic chemistry, and electrical energy storage systems in recent years.

Source: PatSnap R&D Information Database Technology Roadmap

3. Competitive landscape of the downstream application market

The downstream of lithium batteries is the application field of lithium batteries, which can be mainly divided into three categories: energy storage lithium batteries, 3C consumer batteries and power lithium batteries. Among them, the downstream application fields of energy storage lithium batteries are mainly communication base station backup power supply, power grid energy storage, household power energy storage, etc.; the downstream application fields of consumer lithium batteries are mainly mobile phones, digital and other consumer electronics products; the downstream applications of power batteries The field is mainly new energy vehicles.

Among them, power lithium batteries are the core components of new energy vehicles. With the development of the new energy vehicle industry, the demand for power lithium batteries is also expanding. According to the ranking of GGII, in 2021, the first echelon enterprises of my country's power lithium batteries include Ningde Times and BYD, whose installed capacity of power lithium batteries accounts for more than 15%; The market share is between 2% and 15%. The third-tier companies include Tafel New Energy, Yiwei Lithium Energy, Funeng Technology, Sunwoda, etc., with a market share of less than 2%.

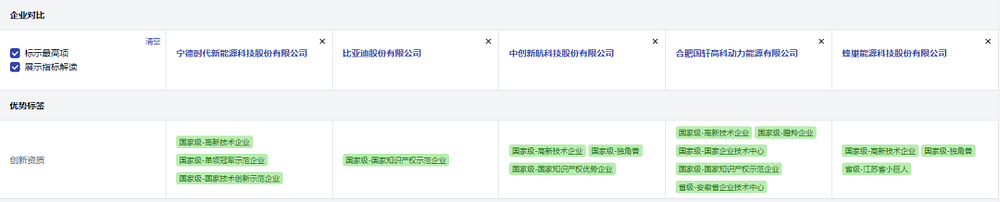

According to PatSnap data, Contemporary Amperex Technology Co., Ltd. currently has more than 9,400 published patent applications, of which invention patents account for 63.53% of the total patent applications; Byd Precision Manufacture Co., Ltd. currently has more than 29,000 published patent applications. Patent applications, of which invention patents account for 57.09%; China Aviation Lithium Battery Co. Ltd. currently has more than 1,500 published patent applications, of which invention patents account for 25.22%; Hefei Guoxuan High-Tech Power Energy Co., Ltd. currently has more than 5,100 patent applications Published patent applications, of which invention patents account for 45.69%; Honeycomb Energy Technology Co., Ltd. currently has more than 3,800 published patent applications, of which invention patents account for 36.35%.

According to the enterprise PK function of the PatSnap Creativity Evaluation Platform, among the above-mentioned enterprises, the number of effective patent applications of BYD Co., Ltd. in the past five years is higher than that of the other four enterprises, and the concentration of patent layout of Ningde Times New Energy Technology Co., Ltd. higher than the other four companies.

Picture source: Enterprise PK of PatSnap Creativity Evaluation Platform

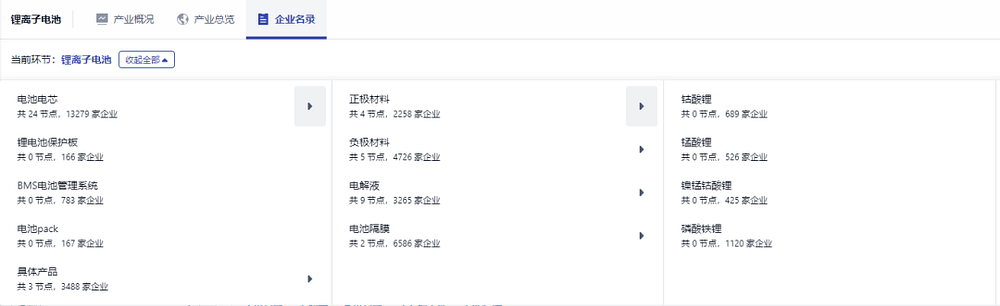

In addition, the PatSnap Creativity Evaluation Platform included 16,119 technology companies with patents in the fields of power lithium batteries, energy storage lithium batteries, and polymer lithium batteries.

Source: PatSnap Creativity Evaluation Platform Industry Chain

As the price of lithium carbonate continues to rise, the cost pressure of downstream battery manufacturers and car companies has increased. Therefore, relatively low-cost sodium-ion batteries have gradually attracted close attention from the capital market.

PatSnap data shows that Ningde Times and its affiliates currently have more than 110 patent applications in the field of sodium-ion batteries, including more than 40 authorized invention patents, mainly in related fields such as positive active materials, Prussian blue, and positive current collectors. From the perspective of the proportion of global patents, China has more than one-third of the world's total patents in the two directions of lithium secondary batteries and sodium-ion batteries, and has a high degree of R&D activity. However, from the perspective of the total number of patents, the patents of lithium-ion batteries accounted for as high as 47% in the past five years, and the CAGR exceeded 100%. The innovation growth rate is very fast. In addition, the sodium-ion battery industry chain has not yet been established. From the perspective of the industry chain, sodium-ion batteries currently do not have a cost advantage over lithium-ion batteries.

Data statement: Enterprise PK data is the result of PatSnap mining based on public information and is for reference only. The results do not constitute any express or implied views or guarantees.