Compared with traditional enterprises, the high-growth, high-risk and asset-light characteristics of “two highs and one light” of science and technology enterprises make it difficult for financial institutions such as banks to use traditional credit indicators to evaluate their technological innovation capabilities. At the same time, due to the fact that the data and information of science and technology enterprises are scattered, and various data barriers are difficult to get through, it also leads to the bank’s evaluation of enterprises being limited to “slicing” at a certain time, and lack of more anchor points for judging the “good” and “bad” of enterprises. The limitations of the evaluation dimension and evaluation cycle further affect the bank’s judgment on the development potential of science and technology enterprises, resulting in practical problems such as the fear of not increasing the credit limit, and the lack of targeted credit solutions.

In response to such pain points, PatSnap launched the “historical rating retrospective” function on the scientific and technological innovation evaluation platform for technological and financial scenarios. This function traces the historical data and trends of the enterprise’s technological innovation capabilities through model algorithms, covering the amount of patent application data of the enterprise in the past 5 years , retracing the technological development process of the enterprise, and visualizing the technological development potential of the technological innovation enterprise. Looking at the “future” from the “past” can to a large extent meet the needs of banks for the difficulty in assessing technological risks of science and technology enterprises, the high requirements for refined analysis, and the need to grasp the technological development trends of enterprises in a timely manner.

Industry leading

The historical credit rating of science and technology enterprises can be traced back to 3–5 years

The intellectual property rights of scientific and technological innovation enterprises are important intangible assets that can reflect their development potential. When evaluating the quality of patented technology assets, the trend change in the number of effective patent applications from patent types can help understand the technological quality level of historical research and development of enterprises. From the perspective of legal status, the proportion of expired patents can help to understand the quality level of the technology currently held by the enterprise.

Based on the basic database of nearly 170 million patents, PatSnap adopts the industry-leading patent data retrospective technology. According to the different dependencies in retrospective calculation, the retrospective indicators are divided into: patent indicators, non-patent indicators, patent value indicators , mining and analysis of the full amount of scientific and technological innovation The company’s 10-year history data, with a visual line chart, clearly shows the company’s effective patent applications in the past two years, the trend of patent invalidation ratio and the change trend of science and technology innovation rating.

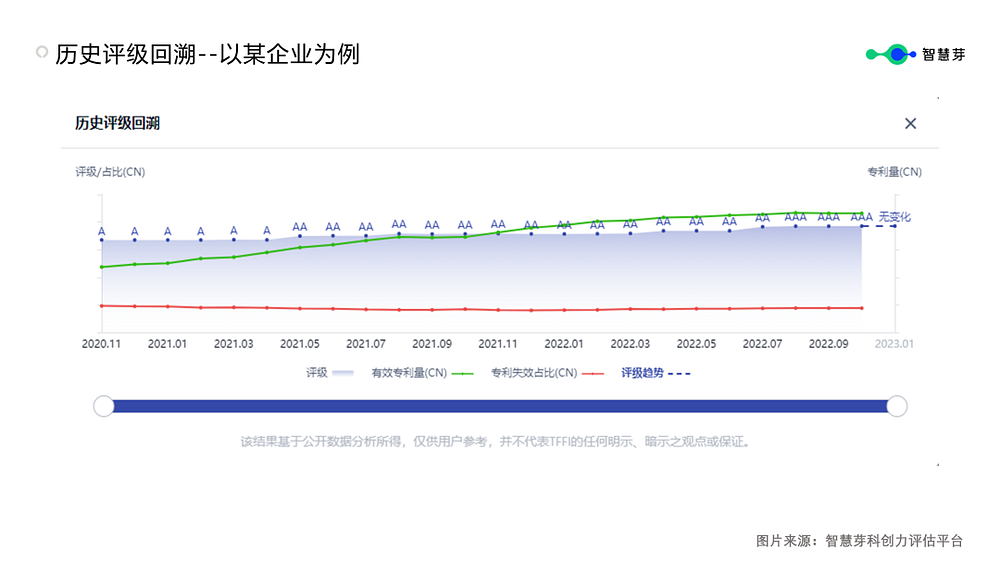

Taking a technology company as an example, the data from PatSnap shows that from November 2020 to September 2022, the number of valid patent applications of the company has been on the rise, doubling from more than 200 to more than 400; the proportion of patent invalidation has decreased 2–3 percentage points, its technical quality exceeds the average value of enterprises in the industry where the enterprise is located, and the scientific and technological innovation capability rating is upgraded from A to AAA according to real-time indicators.

The rating retrospective in the past two years can help financial institutions such as banks to analyze the historical science and technology innovation capability rating data of enterprises in a more objective and refined manner. Combined with the unique data performance of science and technology enterprises, it is comprehensively formed through patent value, science and technology evaluation (technical achievement characteristics) The real distinction of science and technology enterprises, providing differentiated financial services and innovative products.

Find new ways to identify enterprise technology risks

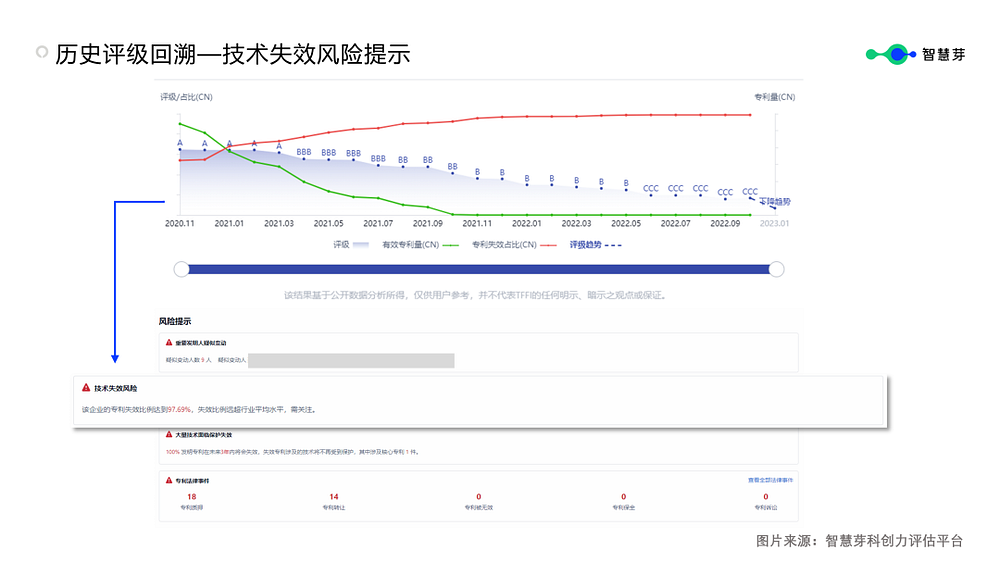

Facing the pain points of banks and other financial institutions that are difficult to identify the technical risks of science and technology enterprises, the historical rating retrospective function provides a new method. For example, from the perspective of the technological development trend of an enterprise , when the historical rating retrospective shows an upward trend and is obvious, it indicates that the enterprise has strong R&D capability in the past two years, has a high level of technical quality, and has great development potential. On the contrary, there may be technical risks. At the same time, the historical rating retrospective chart also includes the display of the rating trend line. PatSnap conducts data mining and real restoration based on the disclosure time of historical patents and non-patents of the enterprise, so as to objectively predict the future trend of scientific and technological innovation ratings of target enterprises based on historical data.

Taking a communication technology company as an example, the data of PatSnap shows that from November 2020 to September 2022, the number of valid patent applications of the company gradually decreased, and the proportion of patent invalidation increased significantly, which shows the company’s research and development efforts in the past two years. At the same time as the decline, the patented technologies currently held by enterprises are also decreasing, and the future rating of science and technology innovation is expected to continue to show a downward trend. Banks and other financial institutions can use this information to conduct due diligence offline in advance to avoid business risks indicated by enterprise R&D risks.

It is worth noting that the newly upgraded PatSnap Creativity Evaluation Platform has established a comprehensive risk management structure, created an accurate technology risk management system and set up risk reminders, and integrated and analyzed the risk information existing in the technology assets of technology enterprises, the suspected changes of important inventors, the protection failure of a large number of technologies, the risk of technology failure and patent legal events, etc, to provide more assistance for credit risk control.

In addition, the PatSnap Creativity Evaluation Platform will continue to dig deep into enterprise patent data, add domestic industry development trend lines and global industry development trend lines , and analyze industry trends to help financial institutions such as banks judge the development of a certain enterprise in the industry situation, potential and other information to explore more possibilities.

Hot companies on Discovery

sitemap vitruvian-investments victron-energy fiberhome-supermicro-information-technology

intercontinental-great secalt bf-argentina plasteco oztent-australia hagiwara-electric-hldgs

mokredit aerus-llc nature-pure-korea froxt shanghai-baif-technology lucid-motors eskort

xxsys-technologies carlyle-group infarm takachiho-koheki