On December 13, Zhihuiya released the “2022 Financial Technology Innovation Index Analysis Report” (hereinafter referred to as the “report”).

The report uses patents as an important indicator for evaluating innovation capabilities, mainly showing:

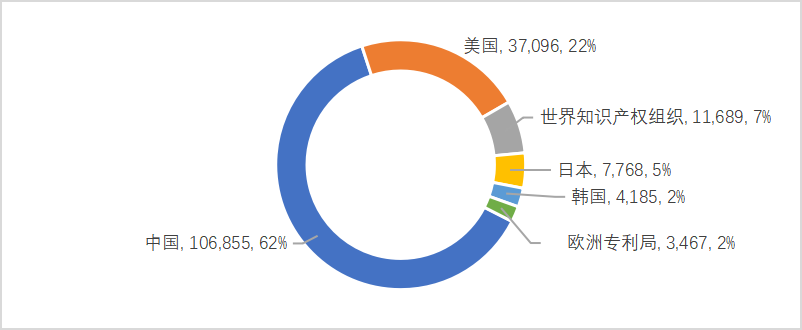

1. The number of patent applications in the field of financial technology has grown rapidly : In the past five years, a total of 190,000 patents related to the field of financial technology have been applied for in more than 50 countries and regions around the world , and the number of patent applications has grown rapidly. Among them, China ranked first in the number of applications, followed by the United States and Japan, with approximately 106,900, 37,100, and 7,800 patent applications, respectively.

2. China’s financial technology innovation is very active : Among the top ten companies in the global financial technology field with patent applications, 7 companies are from China, and 3 companies are from the United States. In order: Ping An Group, Ant Group, Bank of China, Tencent Technology, Capital One Services LLC, Alibaba, Industrial and Commercial Bank of China, China Construction Bank, MasterCard and VISA.

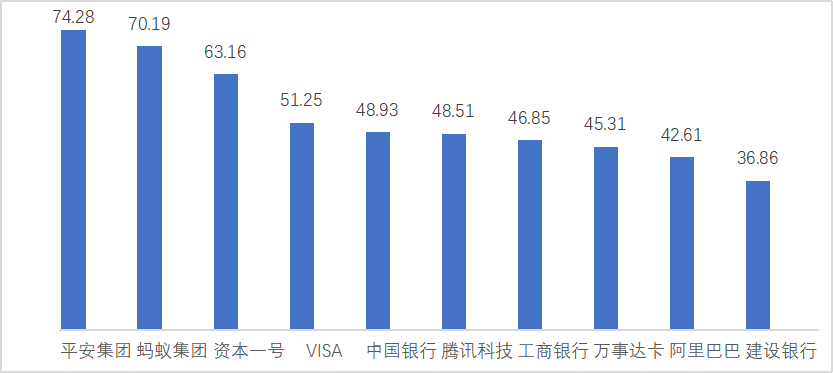

A further analysis of the patent comprehensive index of the top ten companies with the largest number of applications shows that: Ping An Group and Ant Group are in the first echelon, Capital One Services LLC and VISA are in the second echelon, Bank of China, Tencent Technology, Industrial and Commercial Bank of China, MasterCard, Alibaba and China Construction Bank are in the third tier. The patent comprehensive index comprehensively evaluates the comprehensive innovation strength of enterprises from five dimensions: patent foundation, technology quality and breadth, patent quality and layout, current and future influence, and self-research ability.

3. Ping An Group has obvious advantages in the field of segmented tracks : Through the analysis of segmented tracks, it is found that Ping An Group has obvious advantages in the three segments of smart seats, smart claims and risk control technology.

In the past five years, 190,000 new financial technology patents have been added worldwide

China ranks first

Financial technology is rising around the world. Various institutions, including financial institutions, Internet technology companies, and traditional financial IT service providers, focus on the digital transformation of the financial industry and use technologies such as artificial intelligence, blockchain, cloud computing, and big data. Patent layout in the field of financial technology.

In the past five years (January 2018 to October 2022), a total of 190,000 patents related to financial technology have been applied for in more than 50 countries and regions around the world. Among them, the three countries with the largest number of patent applications are China, the United States and Japan, with approximately 106,900 , 37,100 and 7,800 patent applications respectively (see Figure 1).

China is the main technology source country of financial technology, and China’s financial technology innovation is very active.

Figure 1: Patent acceptance by the five major offices and the International Bureau in the field of financial technology

The comprehensive strength of China’s leading enterprises is outstanding

Ping An Group and Ant Group rank in the first echelon

According to Zhihuiya patent statistics, the top 10 companies (Top 10) with the largest number of global patent applications in the field of financial technology in the past five years are Ping An Group (7472) , Ant Group (6616) , Bank of China (2764) , Tencent Technology (2646) , Capital One Services LLC (2513) , Alibaba (2303) , Industrial and Commercial Bank of China (2169) , China Construction Bank (1810) , MasterCard (1785) , VISA (1373) . Among them, 7 companies are from China, and 3 companies are from the United States.

According to the calculation results of the patent comprehensive index of the above Top 10 companies, in terms of patent foundation , Ping An Group, Ant Group, and Alibaba rank in the top three; in terms of technical quality and breadth , Ant Group, Capital One Services LLC, and VISA rank in the top three; in terms of patent quality In terms of investment and layout , Ant Group, Capital One Services LLC and Tencent Technology rank in the top three; in terms of current and future influence , VISA, Industrial and Commercial Bank of China and Ping An Group rank in the top three; in terms of self-development capabilities , Capital One Services LLC, Ping An Group and MasterCard Cards are in the top three.

In general, the Top 10 companies can be divided into three echelons (see Figure 2).

The first echelon: Ping An Group and Ant Group , with a comprehensive score of 70 points or more, of which Ping An Group ranked first with 74.28 points, and Ant Group ranked second with 70.19 points.

The second echelon: Capital One Services LLC and VISA , the comprehensive score is between 50–70 points.

The third echelon: Bank of China, Tencent Technology, Industrial and Commercial Bank of China, MasterCard, Alibaba, China Construction Bank , with a comprehensive score below 50.

As leading companies in this field, Ping An Group and Ant Group have outstanding comprehensive strengths in the financial technology field .

Figure 2: Top 10 companies in the comprehensive index of patents in the field of financial technology

Ping An Group’s smart agents and smart claims

and wind control technology and other segmented track patents have obvious advantages

As technologies such as artificial intelligence, blockchain, cloud computing, and big data continue to be applied in the field of financial technology, new formats and new opportunities will continue to emerge in the field of financial technology. Focusing on the general technology and application scenarios of financial technology, the report discusses how the application of patent achievements can create value in the financial industry from the three subdivisions of intelligent agent, intelligent claim settlement and risk control technology, combined with technological innovation and application scenarios in the financial industry.

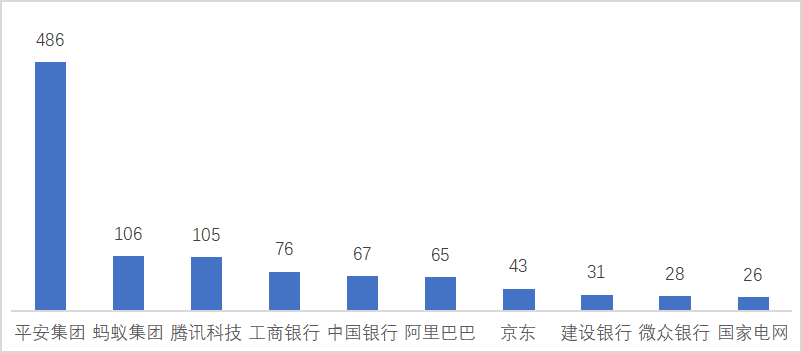

In the smart seat track, Ping An Group, Tencent Technology, and Industrial and Commercial Bank of China occupy the top three positions respectively. Ping An Group has an absolute advantage in the number of applications for smart agents, far surpassing the second place (see Figure 3). Ping An Group’s AI customer service agent model is applied to Ping An Property & Casualty and Life Insurance, and the machine-to-human replacement rate will reach 90% in 2022. In the first three quarters of 2022, Ping An’s AI agent service volume exceeded 1.96 billion, accounting for 82% of the total customer service; the sales scale of AI agent-driven products was about 274.7 billion yuan, a year-on-year increase of 46%.

Figure 3: Top 10 companies with smart agent patent applications

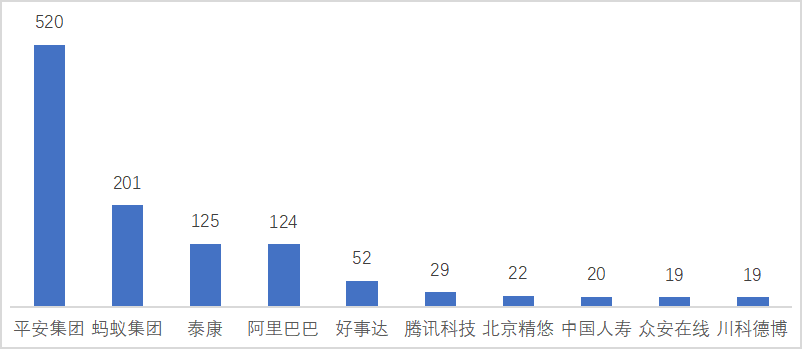

In the smart claims track, Ping An Group ranked first with 520 claims, followed by Ant Group (see Figure 4). On the one hand, because the main business of companies such as Ant Group and Tencent Technology is not insurance. On the other hand, Ping An Group has carried out digital transformation around life insurance, health insurance, property insurance and other businesses in recent years, and increased investment in insurance technology, becoming a leader in the industry. For example, “Extreme Quick Compensation” is a kind of intelligent compensation payment of Ping An Group. Relying on the application of intelligent technology, in the first half of 2022, 770,000 claims were settled, with a compensation amount of 1.69 billion yuan, and the fastest compensation time was just over one minute , 46% of medical cases are paid within 30 minutes.

Figure 4: Top 10 companies with smart claims patent applications

In financial technology, risk control is undoubtedly one of the most important technical application directions. Intelligent risk control mainly uses big data, artificial intelligence technology and scientific decision-making methods to replace artificial intelligence in risk control through automated prediction, rating, and decision-making. Operation, complete tasks that cannot be done manually, optimize marketing, risk control, pricing, lending and post-loan management and other links, improve decision-making accuracy and efficiency, reduce costs, and ultimately improve the comprehensive system of risk control capabilities.

Figure 5: Top 10 Enterprises in the Number of Patent Applications for Risk Control Technology

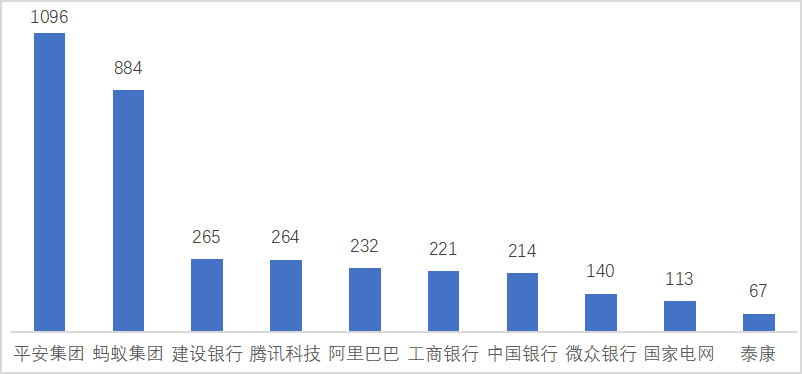

In the risk control technology track, Ping An Group topped the list with 1096, but financial institutions pay more attention to risk management. At present, major domestic banks have more patent layouts in risk control technology, such as China Construction Bank, Industrial and Commercial Bank of China, Bank of China , WeBank, etc.

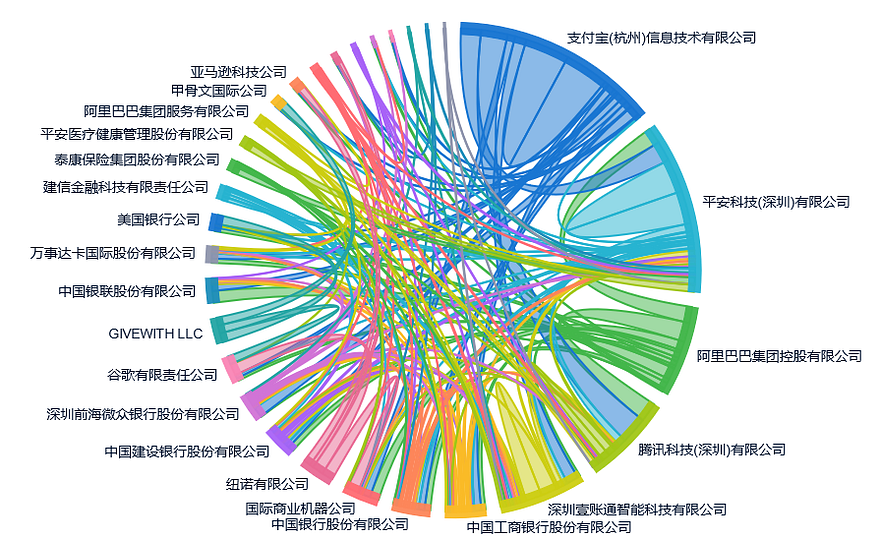

It is worth mentioning that, as an important carrier of financial technology capabilities within Ping An Group, OneConnect pays more attention to independent innovation and global patent layout, and actively applies for high-quality patents around core technologies. According to public information, during the five years from 2017 to 2022, OneConnect’s total investment in technology research and development has exceeded 3.8 billion yuan. Especially in terms of mutual citations of patents related to risk control technologies, OneConnect’s technical output capabilities are already at the forefront of the world, providing strong technical support for Ping An Group (see Figure 6 ).

Figure 6: Mutual citations of patents related to risk control technologies

Looking back at the development history of the financial technology field in recent years, from promoting the construction of bank informatization to driving the digital transformation of the financial industry, from realizing the automation of banking business to building intelligent financial services, from supporting business development with technology to innovating and empowering a new development model. As a technology-driven means of financial innovation, financial technology not only significantly enhances the ability of financial services to serve the real economy, but also continuously improves the coverage and availability of financial services.