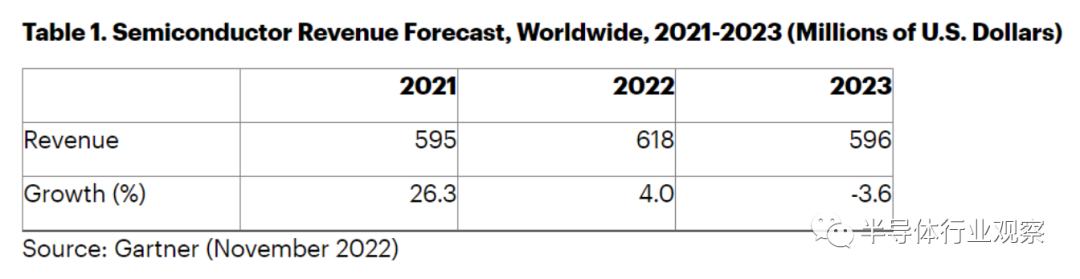

In the second half of 2022, the overly sluggish economic situation has cast a cloud over the development of the global semiconductor industry. Just recently, for the global semiconductor market in 2023, two major analysis organizations, Gartner and IC Insights, have given unoptimistic views. Gartner predicts that the rapid deterioration of the global economy and the slowdown in consumer demand may have a negative impact on the semiconductor market in 2023. The global semiconductor revenue forecast for 2023 will be revised down from US$623 billion to US$596 billion, a decrease of 3.6% from this year; IC Insights’ latest forecast also pointed out that after the record-setting global semiconductor sales in 2022, semiconductor sales are expected to decrease by 5% annually in 2023, due to the collapse of memory prices and global economic uncertainty, which will put pressure on next year.

Source: Gartner

To some extent, the whole world seems to be caught in chip “anxiety”, but compared with the menacing European and American regions, the “chip anxiety” in Asia seems to be particularly serious.

South Korea’s ICT exports drop for consecutive April

Semiconductors are the lifeblood of South Korea’s economy. The Korean semiconductor industry has entered a stage of rapid development since the 1980s. With the support of the government and the vigorous development of enterprises, the status of Korean semiconductors has risen all the way, ranking among the best in the world. According to IC Insights data, the total sales of the global semiconductor market in 2021 South Korea came in second with 22%.

However, recently, South Korea’s semiconductor industry has been somewhat “stretched” in terms of corporate rankings and ICT exports. At the end of October, the National Federation of Economics and Businessmen of Korea listed the top 100 international semiconductor companies in terms of average market capitalization from January to September this year based on the Standard & Poor’s Capital IQ, and analyzed relevant business indicators. Among Korean companies, only Samsung Electronics, SK Hynix, and SK Square has 3 companies on the list , and Samsung Electronics, which was ranked first in 2018, also fell to third place.

Not only Samsung, but the rankings of the other two companies on the list are also falling rapidly. SK Hynix fell from 10th in 2018 to 14th. SK Square, which was separated from SK Telecom at the end of last year, fell from 80th in just one year. dropped to 100. The net sales yield of Korean semiconductor companies has also dropped from 16.3% in 2018 to 14.4% in 2021.

Of course, in the short term, what worries Korean semiconductors the most is the weakening of the storage market. As we all know, South Korea is a well-deserved storage country, with DRAM chips accounting for 71.1% of the market, and NAND chips accounting for 44.9%. It has two well-known storage companies, Samsung and SK Hynix. However, during the down cycle of semiconductors, memory chips have become an IC subdivision field facing the impact of the “cold winter”. The WSTS forecast report shows that storage sales in 2023 are expected to drop by 17% to US$111.624 billion. In contrast, logic chips are expected to decrease by only 1.2%, Micro by 4.5%, and Analog by 1.6%. Gartner also predicts that the storage market will drop by 16.2% next year, of which DRAM will fall into an oversupply situation during January-September 2023, and NAND Flash will fall into an oversupply situation during January-June 2023.

The direct impact of the slowdown in the growth rate of the memory chip market is the decline in prices. The latest TrendForce research report shows that the current spot quotations for DRAM and NAND flash memory are still on a downward trend. Korean media believe that the decline in the price of memory chips may affect South Korea’s overall exports.

In fact, South Korea’s ICT exports have dropped for four consecutive months. Since the second half of this year, due to the shrinking global consumption, the decrease in demand for consumer electronics, and the decline in the price of semiconductor DRAM, South Korea’s ICT exports have shown a downward trend for four consecutive months from July to October (the ICT exports in July decreased by 0.7% year-on-year ; decreased by 4.6% year-on-year in August; decreased by 2.2% year-on-year in September; decreased by 10.3% year-on-year in October), this is the first time since January 2020 that South Korea’s ICT exports have fallen for four consecutive months year-on-year.

Contrary to the continuous decline in exports, South Korea’s ICT imports are rising steadily. Even in August, South Korea’s ICT imports increased by 18.7% year-on-year to US$13.52 billion, the highest record since the start of ICT import and export statistics in 1996. . Affected by this, the scale of South Korea’s trade balance surplus in the ICT sector has shrunk significantly. Data show that Korea’s ICT trade balance surplus reached US$4.11 billion in October, a sharp decrease from September’s US$7.94 billion, and a sharp decrease from the US$7.8 billion surplus in the same period last year. For an export-oriented country (South Korea’s export-to-GDP ratio will be as high as 35.6% in 2021, much higher than other industrial countries), the decline in exports is likely to directly hit GDP growth.

In addition to the shrinking surplus, the proportion of trade exporting countries has also become an object of concern for Korean semiconductors. Statistics show that compared with the United States, Japan, and Singapore, the Chinese market accounts for a relatively large proportion of the South Korean semiconductor industry. Since 2015, the Chinese market has basically maintained around 40%. The total amount of South Korean semiconductor exports to China in the first three quarters of this year is 42.013 billion US dollars, accounting for 41% of South Korea’s total semiconductor exports during the same period. According to Korean media BusinessKorea, South Korean market experts said that South Korea’s semiconductor exports need to reduce the proportion of China, because the current situation is very vulnerable to China’s economic fluctuations.

In response to the turbulent industrial situation, the South Korean government has taken active measures in policy. On July 21, South Korea announced the “Semiconductor Superpower Strategy”, which plans to guide enterprises to complete the investment of 340 trillion won in the semiconductor industry by 2026; on August 4, the National Power Party submitted to the National Assembly tax relief for expanding facilities investment In September, South Korean President Yin Xiyue attended the activities of the Special Committee on the Semiconductor Industry of the National Power Party and expressed his clear support for accelerating the legislation of the Korean semiconductor industry.

On the corporate side, Samsung and SK Hynix have taken two diametrically opposed measures, one aggressive and the other conservative. Samsung firmly stated that Samsung Electronics will not be shaken by industry conditions and will continue to invest without considering production cuts. It believes that once the market recovers, insufficient investment in a downturn may damage business. At the same time, it has recently been reported that Samsung Electronics will establish a new global research institution under the DS Division in December, which is expected to analyze the semiconductor market and other related industries and discover new markets.

SK Hynix announced at the end of October that due to the sharp drop in demand for memory chips, capital expenditures will be cut in half next year. In July of this year, SK Hynix also froze an investment plan for a domestic semiconductor factory in South Korea. The new plant called “M17”, which was originally scheduled to be put into operation in Cheongju City in central South Korea in 2025, will be postponed indefinitely. Reasons for the delay include China’s epidemic prevention and control; sluggish sales of personal computers and smartphones; rising raw material prices and the appreciation of the US dollar have led to higher costs for the introduction of production equipment.

“Resurgent” Japan

In the past 35 years, under the pressure of Japanese companies’ ignorance of “IDM” and the “strangling” of the United States, the market share of the Japanese semiconductor industry has fallen from 50% at the peak in the past to less than 10% in 2020. Although Japan has put the revival of the semiconductor industry on the agenda in recent years, in today’s general environment, the Japanese chip industry is also facing new anxieties.

First of all, it is the reduction of net profit. Affected by the high inflation in the United States, the deterioration of the semiconductor business climate and the rising prices of raw materials, even the depreciation of the yen cannot save the net profits of Japanese companies. According to Daiwa Securities data, the help brought by the yen’s depreciation against the dollar by 1 yen has been reduced by half compared with 2009. Although the current exchange rate of the yen against the US dollar has depreciated by more than 20 yen compared with the same period last year, the sensitivity of the exchange rate is getting lower and lower, which affects the extent of profit improvement.

Although there are also cases in Japanese companies such as Shin-Etsu Chemical, which have successfully absorbed the increased costs by actively promoting price increases, but these are also rare, and most companies still suffer from soaring costs. According to the “Nihon Keizai Shimbun” report, listed companies in the Japanese manufacturing industry, the net profit forecast for the second half of 2022 (to March 2023) will decrease by 2% compared with the same period last year. If the forecast is accurate, it will be the first since the first half of 2020.

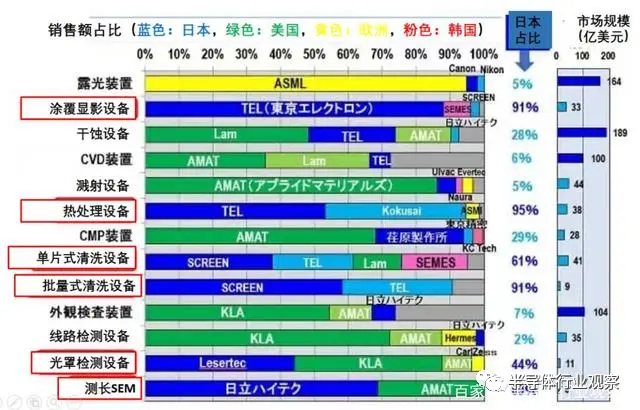

Secondly, it is the postponement/reduction of capital expenditure of the fab, which causes the “cold wind” of the semiconductor industry to eventually blow to upstream manufacturers such as equipment/materials. Although the Japanese semiconductor industry is far less brilliant than in the past, the two major fields of materials and equipment are still “pulsating” the global semiconductor industry. For example, in the field of photoresist, Japan occupies 4 of the top 5 leading photoresist companies in the world, accounting for about 70% of the photoresist market share; and in the field of coating and developing equipment, Japan’s TEL is even more dominant. .

Source: business-journal

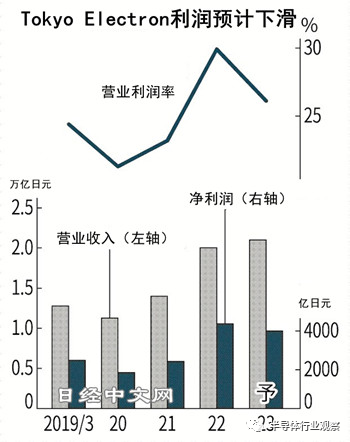

However, the recent declining demand for semiconductors has made semiconductor manufacturers’ enthusiasm for investment subside. Wafer foundries including TSMC, World Advanced, and PSMC, as well as storage manufacturers such as Micron, Nanya, SK Hynix, and Kioxia, have increased their investment significantly. The reduction of capital expenditure has directly hit the upstream equipment/material market. SEMI predicts that the investment in pre-process equipment used to form semiconductor circuits will turn negative growth for the first time in 4 years by 2023. TEL also said a few days ago that semiconductor manufacturers have postponed their investment plans in production machines one after another, so they have revised down their annual net profit forecast to 400 billion yen, which is the first downward revision in the past four years.

Source: Nikkei Chinese Network

Although the current demand for semiconductor equipment/materials is stagnant, Japanese manufacturers are still actively expanding production. In the field of semiconductor equipment, Japan’s V-Technology established its own production base for the first time; Japan’s KOKUSAI ELECTRIC will invest 24 billion yen to build a new factory in Tonami City, Toyama Prefecture; Canon will expand its production of lithography machines in Utsunomiya City, Tochigi Prefecture Build a new factory and strive to start production in the spring of 2025, doubling the production capacity…

In the field of semiconductor materials, Toppan Printing is expected to invest about 20 billion yen to expand the production capacity of masks in Japan and Taiwan, China, through its subsidiary “Toppan Photomask” by 2023; The production plants in mainland China and Taiwan invested nearly 10 billion yen to increase production lines; Shin-Etsu Polymer, a subsidiary of Shin-Etsu Chemical, will invest about 10.5 billion yen to expand the production of 12-inch wafer shipping containers…

In addition to equipment and material manufacturers, Japan’s eight giants also joined forces to make cores and develop advanced technology in an attempt to revive. On November 11, the Ministry of Economy, Trade and Industry of Japan announced that eight large Japanese companies, including Sony, SoftBank, Toyota Motor and NTT, have formed a new company, Rapidus, with the goal of mass producing advanced semiconductors below 2nm that have not yet been practically used in the world. Semiconductor, put into production after 5 years. It is reported that each of the companies participating in the joint venture will invest about 1 billion yen, Mitsubishi UFJ Bank will invest 300 million yen, and the Japanese government will inject about 70 billion yen. It can be seen from the investment amount that the Japanese government has restored its former glory in the semiconductor field great determination.

China in a different way

As for mainland China, under the influence of various factors such as increasingly severe geopolitics, sluggish market environment, and masks, the development of the chip industry in mainland China is also extremely difficult, but we have still opened up a way forward. It is a mature process. Although it is far behind the advanced manufacturing process to catch people’s attention, mature technology is where the vast majority of the world’s demand lies. What the manufacturing industry needs most are power semiconductors, sensors, and simulation components for controlling motors. The technology requirements for chips are only 28. Around 40 and 65nm. As for the automotive chips we are familiar with, the most lacking is mature chips. Each MOSFET chip costs only US$0.40, but it will affect the production of tens of thousands of cars.

Taking SMIC , the leading OEM in mainland China , as an example, it recently stated on the investor interaction platform that in the next five to seven years, there will be a total of about 340,000 12-inch new For the construction project of the production line, the company will promote the development of diversified platforms, the combination and expansion of production capacity according to the needs of customers. Since 2020, SMIC has embarked on the road of production expansion. In 2020, SMIC Beijing, SMIC Shenzhen and SMIC Oriental in 2021, and SMIC Xiqing in 2022, the above fabs are all focused on Manufactured at 28nm and beyond.

Public data shows that in 2021, SMIC’s wafer manufacturing capacity will be about 6.75 million 8-inch wafers per year, while the above-mentioned four fabs will add a total of 340,000 12-inch wafers per month, equivalent to 9.18 million 8-inch wafers. /year, it can be seen that SMIC has made great efforts to expand production in the mature process field. SMIC pointed out that in the future, at least 1/3 of the new factory will be shared capacity to meet the dynamic needs of customers; 2/3 will be for specific market segments and technology iterations. More importantly, at the moment when TSMC, PSMC and other major wafer foundries are reducing capital, SMIC is still advancing against the trend. At the third quarter performance briefing, SMIC stated that in order to help 12 Inch production lines, the annual capital expenditure plan was raised from US$5 billion to US$6.6 billion against the trend.

Another foundry giant Hua Hong Semiconductor , which is sprinting towards the science and technology innovation version, also disclosed the news of a huge investment in expanding production in its recent prospectus. According to the prospectus, Hua Hong Semiconductor intends to raise 18 billion yuan to invest in Hua Hong Manufacturing (Wuxi) project, 8-inch factory optimization and upgrading project, characteristic process technology innovation research and development project, and supplementary working capital and other projects. Among them, the Huahong Manufacturing (Wuxi) project plans to invest 6.7 billion US dollars to build a 12-inch special process production line with a monthly production capacity of 83,000 pieces after it is put into production. Production will begin in 2025.

Hua Hong Semiconductor said that as the production capacity of the Hua Hong Wuxi project continues to climb, further capital investment in the future will greatly increase the production capacity of the 12-inch production line and the richness of the product portfolio based on various process platforms based on 90–55 nanometer nodes. Continue to consolidate its industry position as the world’s leading semiconductor foundry manufacturer.

In addition, Cansemi Semiconductor also recently announced the completion of several hundred million yuan of B-round strategic financing, which is the second external financing expansion within this year. In July this year, Cansemi Semiconductor announced the completion of 4.5 billion yuan in financing, and the financing funds were mainly used for the third phase of the project. It is reported that the third phase of the Cansemi Semiconductor project was officially launched on August 18. It is expected that the new production capacity will be 40,000 pieces per month after the project reaches production, but the positioning of the production line process has been changed from “55–40nm, 22nm process” to “180nm process”. -90nm process”.

Let’s look at China’s Taiwan again. As a global semiconductor powerhouse, Taiwan’s strength is very strong, but even so, it is also facing a certain degree of chip anxiety. Judging from the latest news, brain drain has become a new focus of everyone’s attention. Earlier media reports said that TSMC chartered a flight to send nearly 300 employees to the United States for the first time in early November. It is expected that more than 1,000 TSMC employees and their families will continue to be sent to the United States every two weeks at the beginning. As soon as the news came out, Chen Fengxin, a senior media person, warned. Chen Fengxin said that Taiwan’s talents are being hollowed out. With the first batch of TSMC talents going to the United States, chronic blood loss will form in the future.

Chen Fengxin emphasized that Taiwan does not have a big market and does not produce any resources. The only advantage it has is manpower and talents. Taiwan used hard-working manpower in the early days, and there were many processing and exporting areas. At that time, processing and exporting areas were very helpful to Taiwan’s economic growth; By 1980, the group of people who had studied in the United States from top universities in the early years set off a wave of returning to Taiwan. These talents gathered a new industrial model and put the “technology-intensive” thing in Taiwan. But now the situation is reversed. Chen Fengxin pointed out that TSMC faces a talent problem when investing in the United States, so it can only move talents from Taiwan. As batches of talents go to the United States, chronic blood loss will form.

Although TSMC stated that every new factory in and outside Taiwan has short-term expatriate engineers, and the number is very limited compared with the number of employees, there is no doubt that talents will be “hollowed out”, but in the long run, it is true that Taiwan, China will not Therefore, the rapid loss of talents still needs to be marked with a “question mark”.

In addition, in the face of concerns about oversupply in the semiconductor industry and supply chain imbalances, Taiwan’s annual chip output value has also been lowered. The International Institute of Obstetrics (IEK) of the Taiwan Industrial Technology Research Institute (IEK) stated at the end of November that the annual output value of the IC industry this year has been revised down from the original estimate of 4.98 trillion yuan to 4.72 trillion yuan; the output value of the IC industry next year will be revised from the original estimate of 5.4 trillion yuan. , revised down to $5 trillion.

IEK pointed out that the adjustment of the overall semiconductor inventory is quite obvious in the second half of this year, resulting in the convergence of revenue growth in the third quarter including IC design, manufacturing, packaging and testing. It is estimated that the fourth quarter will show a quarterly decrease of 13.3% and an annual decrease of 2.3%. In the fourth quarter, only the IC manufacturing industry and the packaging and testing industry maintained quarterly growth, while the IC design industry will show a quarterly decrease of 16%, dragging down the overall IC output value performance.

For the leading TSMC, Gokul Hariharan, director of research at JPMorgan Chase Securities in Taiwan, pointed out that due to major customers such as Qualcomm, Nvidia, and AMD cutting orders for the 5nm process, the situation of the 7nm process is not ideal, so the first and second quarters of next year TSMC’s revenue will decrease by 9% and 12% quarterly in US dollars, which also means that its operating conditions in the first half of next year will enter the bottom period.

Of course, we cannot underestimate Taiwan’s chip strength because of the short-term downgrade of the chip industry and operating conditions. Even if the output value is revised down, the annual growth of Taiwan’s output value this year and next will still be higher than the average level of the global semiconductor industry. Moreover, JP Morgan Securities also emphasized that as the 3nm process begins to increase in volume and the inventory correction comes to an end, TSMC’s operating performance will recover steadily in the second half of the year. Revenue will rebound quickly, with an annual growth rate of 21%.

Judging from the recent news, major global manufacturers are actively increasing Taiwan. According to Taiwan media reports in November, ASML will launch the largest investment in Taiwan in history. Hou Youyi, Mayor of New Taipei City, Taiwan, confirmed on the evening of November 16 that ASML will be located in the Linkou Gongyi Industrial Zone. The first phase will invest NT$30 billion and about 2,000 employees will be stationed. Korean media pointed out that ASML’s investment in Taiwan is five times that of South Korea. In addition to ASML, Mei Mingming will invest NT$80 billion (including purchases) in Taiwan next year, and will introduce the most advanced 1γ technology, which will be mass-produced in 2024. In addition, TSMC’s 1nm fab is expected to land in Longtan Park, with an investment of NT$ trillion; Qualcomm has also expanded its foundry orders in Taiwan. According to statistics from the Business Times, from 2020 to 2025, manufacturers of semiconductors and related equipment and materials will invest 3.8 trillion yuan in Taiwan.

Source: Business Times

At the same time, Taiwan, China is also designating the “Taiwan Chip Act”, which is expected to be launched on New Year’s Day in 2023. Companies such as TSMC, MediaTek, Novatek, UMC, ASE, Macronix, and Nanya Branch are expected to enter the list of tax cuts. In addition to Taiwanese companies, such as ASML is also expected to benefit from this, so as to promote the layout of foreign companies in Taiwan. However, while the bill has attracted attention, it has also brought a lot of controversy. Huang Chongren, chairman of PSMC, publicly stated that he would take care of Taiwan’s semiconductor industry through the deduction of equipment investment. He affirmed and was optimistic about its success. Provide TSMC or a small number of equipment manufacturers subsidies. “What is advanced manufacturing process and forward-looking research and development, the government must make it clear,” Huang Chongren said, “If it is targeted, such a bill amendment is too unfair and unreasonable.”

This article is reproduced with authorization, and the content is reproduced from the official account [Semiconductor Industry Observation] ID: icbank, author: Gong Jiajia. The article only represents the original author’s point of view, and does not represent the position of the hard technology official account.

Hot companies on Discovery:

parke-bank, metromile, park-industries, proactis, oakam-finance, tirunelveli-medical-college, aanstar-technologies, fannin-tree-farm, the-shelter-insurance, ingersoll-cutting-tool, wayfair, td-synnex, equiniti-group, enson-group, quest-diagnostics, koki-uchiyama, west-gate-bank