With the background of economic development trends and favorable policies, the vitality of technology and financial innovation continues to increase. Banks and other financial institutions continue to make efforts to support technology-based small and medium-sized enterprises, and continue to innovate personalized financial products, tools and services to help the high-quality development of the real economy.

At present, banks and other financial institutions are still facing the difficult problem of investment and financing review when they are innovating in technology and finance. In the past, the traditional credit evaluation method of banks and other financial institutions is to investigate the target company before and after the business. Visit companies in the upstream and downstream industrial chains of enterprises to understand the comprehensive situation and provide support for risk management and control.

However, traditional credit evaluation indicators are not suitable for high-growth, high-risk, and asset -light “two highs and one light” characteristics of high-tech SMEs. So what aspects should banks and other financial institutions focus on to objectively and effectively evaluate technology-based SMEs? technological risk, technological innovation strength?

1、Focus on the company’s competitiveness

It is relatively broad and inaccurate for banks and other financial institutions to analyze the technical field and technical strength of enterprises through industrial and commercial data such as traditional business scope.

Therefore, it is necessary to evaluate from a more comprehensive dimension, such as enterprise qualification and capital market recognition , and at the same time evaluate the actual competitiveness of the enterprise based on the position of the enterprise in the same industry, the same region, and the same technology field . There are also some technology companies that put their patents under their subsidiaries, and the simple evaluation of patent capabilities may be “distorted”.

Based on the business information of enterprises, Zhihuiya’s innovation evaluation platform uses big data to calculate and display multi-level equity structure diagrams. By analyzing the data of corporate shareholders and foreign investment, it is displayed in the form of graphs, helping banks and other financial institutions to quickly and efficiently understand corporate investment. Equity relationship, risk avoidance.

At the same time, the Zhihuiya Creativity Evaluation Platform also includes the past financing experience of technology companies, which allows financial institutions to easily refer to the company’s recognition in the capital market.

Figure 1: Taking BOE Technology Group Co., Ltd. as an example

(Click on the picture for the complete report to enter Zhihuiya Innovation Evaluation Platform to view)

2、Pay attention to the scale and stability of enterprise R&D

To understand the R&D strength of a company, we can also start from the scale and stability of the company’s R&D. Through the Zhihuiya Creativity Evaluation Platform, banks and other financial institutions can clearly understand the company’s R&D scale, R&D sustainability, and the stability of the core R&D team .

Zhihuiya uses big data capabilities to collect and analyze the quantity, size and structure of a company’s patent rights, software copyrights and trademark rights, and comprehensively analyze a company’s R&D strength.

Through the comprehensive analysis of the company’s patented technology output frequency and authorization ratio fluctuations, the company’s R&D sustainability can be comprehensively analyzed, and at the same time combined with the size of the company’s inventors and the stability of important inventors, it can gain insight into the company’s future R&D strength and stability.

Figure 2: Taking BOE Technology Group Co., Ltd. as an example

(Click on the picture for the complete report to enter Zhihuiya Innovation Evaluation Platform to view)

3、Pay attention to the technical layout of the enterprise

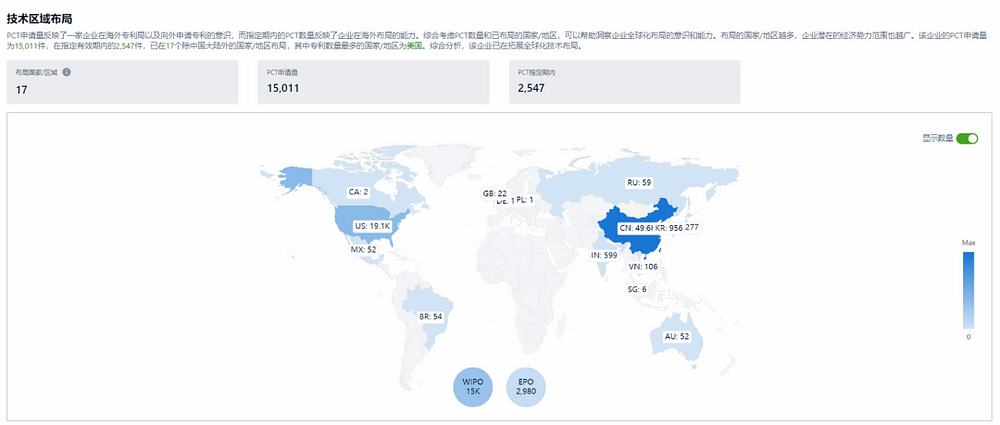

From the region and technical field of the enterprise’s technical layout, we can gain insight into the business development direction and strategy of the enterprise, and understand the potential sphere of influence of its technology in the economic market and technology market.

Zhihuiya’s innovation evaluation platform shows the company’s PCT application volume and the countries/regions it has deployed to gain insight into the awareness and capabilities of the company’s global layout. At the same time, it analyzes the technology research and development areas that the company has recently focused on through algorithms to gain insight into the company’s key technology trends and layout field.

Figure 3: Taking BOE Technology Group Co., Ltd. as an example

(Click on the picture for the complete report to enter Zhihuiya Innovation Evaluation Platform to view)

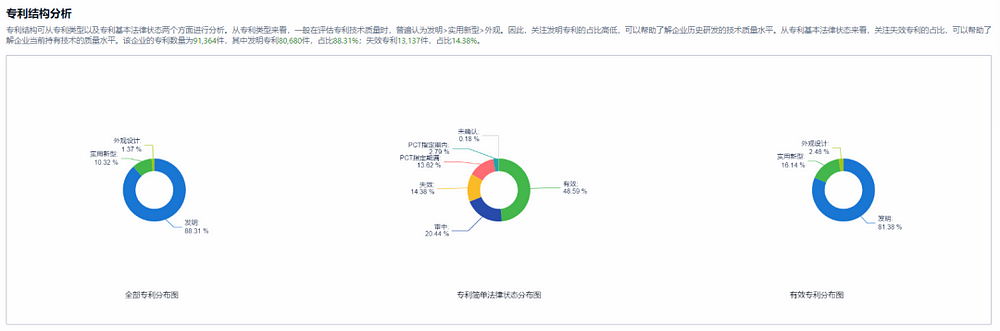

4、Pay attention to the quality of enterprise technology

Technical quality can be developed from three aspects: enterprise patent structure, patent value, and patent life expectancy .

Among them, objective and accurate evaluation of the patent value of enterprises is also a major problem in the business process of banks and other financial institutions. Zhihuiya is based on 170 million patent big data from 158 countries around the world , adopts information entropy self-supervised learning, NLP, integrated learning and other machine learning technologies, creates more than 80 patent value evaluation indicators, and comprehensively uses the market method, combined with Zhihuiya’s unique The patent value analysis and evaluation model is formed to help financial institutions objectively and accurately evaluate the patent value of enterprises.

Figure 4: Taking BOE Technology Group Co., Ltd. as an example

(Click on the picture for the complete report to enter Zhihuiya Innovation Evaluation Platform to view)

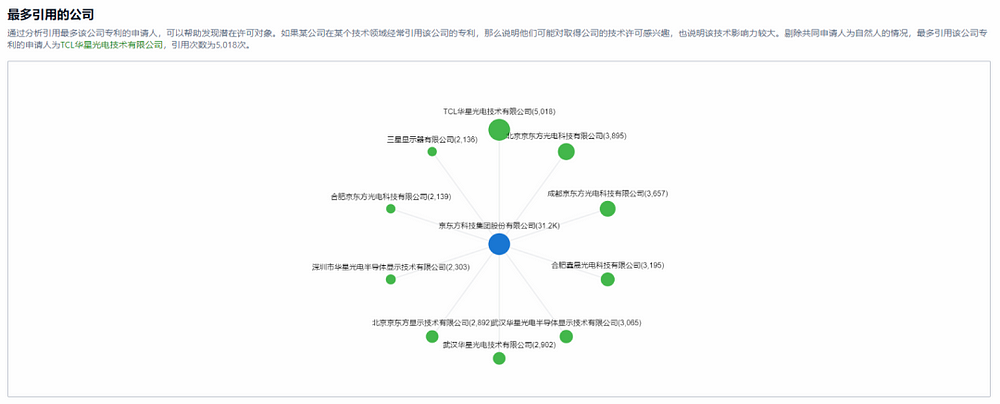

5、Pay attention to the influence of enterprise technology

High-quality, cutting-edge technologies are often cited and referenced with higher value. Therefore, financial institutions such as banks can comprehensively evaluate the technological influence of enterprises and gain insight into the technological innovation capabilities of enterprises from the citation and transfer of patents.

Figure 5: Taking BOE Technology Group Co., Ltd. as an example

(Click on the picture for the complete report to enter Zhihuiya Innovation Evaluation Platform to view)

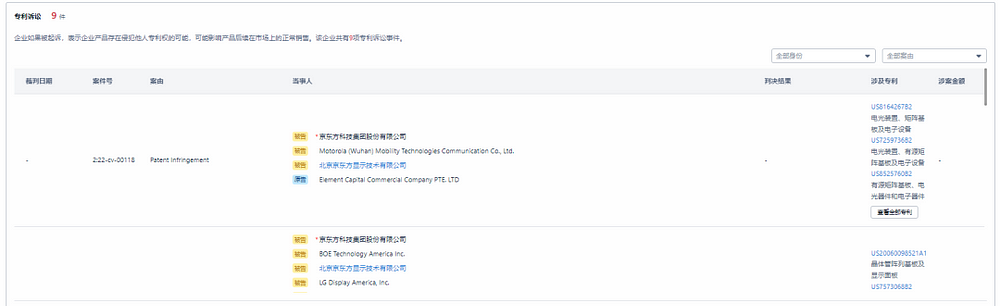

6、Pay attention to patent risk information

Banks and other financial institutions need to identify the technical risks of enterprises in a timely manner, whether before or after lending, and can comprehensively evaluate them from five aspects: abnormal indicators, suspected changes of important inventors, a large number of technologies facing protection failure, technology failure risks, and patent legal events The risk profile of the enterprise.

Among them, patent legal events such as patent transfer, patent preservation, patent invalidation, patent litigation, and patent pledge are the core intellectual property information that every high-tech enterprise pays attention to, and it is also the key information for financial institutions to investigate and analyze the patent information of enterprises. Zhihuiya The scientific innovation evaluation platform adopts the combination of AI technology and expert analysis to standardize patent information and litigation cases, and expand all patent litigation events involved in the enterprise.

At the same time, Zhihuiya’s industry-leading patent data backtracking technology supports backtracking the company’s patent application data for up to 10 years, and infiltrates quantitative analysis and refined management and control capabilities into pre-loan access, incoming application, credit approval, and loan monitoring , post-loan tracking and other credit life cycle.

Figure 6: Taking BOE Technology Group Co., Ltd. as an example

(Click on the picture for the complete report to enter Zhihuiya Innovation Evaluation Platform to view)

Zhihuiya revolves around the technology financial service scene, analyzes technology big data with intellectual property rights as the core, and forms an enterprise technology innovation evaluation model based on the company’s competitiveness, R&D scale and stability, technology layout, technology quality, and technology influence . At the same time, aligning with the general standards of the industry, referring to the internationally accepted “four-grade ten-grade system” rating scale and China’s general standards, combined with the characteristics of scientific and technological innovation enterprises, a 9-level rating system is used to rate the scientific and technological innovation capabilities of enterprises.

In addition, Zhihuiya’s innovation evaluation platform analyzes the technical field of enterprises through algorithms, helping banks and other financial institutions to quickly verify the main business and major competitors of the enterprise. At the same time, it supports one-click comparative analysis of 29 indicators, and can efficiently understand the company’s position in the same technology field during pre-loan due diligence and loan company review. Combined with the distribution and ranking of enterprises in the same industry, it is convenient for financial institutions to benchmark and locate target enterprises, make accurate assessments, and provide differentiated business support.

At present, Zhihuiya’s financial solutions have served dozens of leading institutions including state-owned commercial banks, joint-stock commercial banks, private banks, well-known domestic and foreign investment institutions and credit reporting companies.

Hot Companies on PatSnap:

xpressdocs-partners,frp-advisory,parexel-international,pgnig,equitable-life-insurance,jbh-consulting-group,bluestack-systems,ebroadcast-technologies,onemain-financial,sigma-care-development,spotify,cti-foods,helix-opco,waypoint-analytical,upserve,umpqua-bank,billie